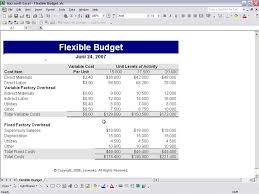

This enables a company to arrive at the budgeted cost, whatever be the level of activity attained. Instead of preparing for a standard level of activity, they are prepared for a range of activities. Flexible budgets are the opposite of static budgets.Some of the important characteristics of a flexible budget can be summarized as follows: Now when sales are actually $4 million or $6 million, the flexible budget for sales commission expense will be set at $200,000 or $300,000 respectively. However, if you use a flexible budget, it might express the sales commission expense as a specific percentage of sales (say 5%). Now if you use a static budget, sales commission expense will be budgeted at $350,000 only whether the actual sales for the budget year are $4 million or $6 million. Suppose you set your sales commission budget at $350,000. The company would have gone after $720,000 rather than $736,000 to set its budget benchmark for 69,000 units. Had the company been using a fixed budget of $720,000 which stays stagnant with a 65,000 level, it would have given misleading results. If actual costs are going beyond $736,000, your company may take measures to control them. Such budgeted costs will act as a benchmark to exercise control over actual costs. With this computation, the management can now logically compare its actual costs at 69,000 level of output with budgeted cost ($736,000) at the same level of output (i.e., 69,000). Therefore, the department’s budget will be re-drawn based on the output level of 69,000 items in the following way:įixed expenses (salaries, maintenance of machinery, etc.) of $460,000 + Variable expenses (materials, wages, etc.) of $276,000 (69,000 items X $4 each) = Total flexible budget of $736,000. It will adjust the elements of costs in proportion to the output generated. ( source)Ĭontinuing our discussion with the above example, a flexible budget will increase or decrease according to the actual number of items produced, i.e., 69,000. This facilitates in logical comparison of budget allowances with actual costs as a means of control. Unlike fixed budgets, when a flexible budget is used, the actual cost of actual volume is compared with the budgeted cost of actual volume, i.e., two things to the same base. If production volume changes, the expenditure appropriate to it can be easily established from a flexible budget. The key feature of a flexible budget is that it depicts expenditure appropriate to various levels of output. It is a budget prepared in such a way that it provides the budgeted cost for any level of activity. Meaning of flexible budgetīy identifying the distinction between fixed, semi-fixed, and variable cost, a flexible budget is designed to change in relation to the activity attained. Thus, it will be meaningless to adopt the budgeted cost of $720,000 at 65,000 level of output to compare it with actual costs at 69,000 output level.īecause of these flaws in fixed budgeting, it has become a normal practice in businesses where sales and production cannot be precisely forecasted to abandon the concept of fixed budgeting, as it does not allow for automatic volume adjustments. But since a fixed budget is prepared at a standard level of activity and cannot be moulded to make it comparable with the actual level of activity, it will not serve any purpose. The actual activity is usually less or more than the one assumed for making a budget. It is only in rare circumstances that the level of output actually attained conforms to the one assumed for budgeting purposes. If we use a fixed budget, it is going to remain the same at $720,000 and will not be changed when more or less than 65,000 items are produced. Now, suppose your company produces 69,000 items as opposed to 65,000 assumed at the time of making the budget.

A summary of the department’s budget based on the output level of 65,000 items is:įixed expenses (salaries, maintenance of machinery, etc.) of $460,000 + Variable expenses (materials, wages, etc.) of $260,000 (65,000 items X $4 each) = Total fixed budget of $720,000. The departmental budget is prepared based on the assumption that 65,000 items will be produced during the budget year. Imagine your company is making an annual departmental budget for its manufacturing division.

It does not vary as the level of activity in your business rises or falls. What is a fixed budget?Ī fixed budget is one that is created using a standard or fixed level of activity. While one is rigid, the other is adjustable to your business’s output level (be it sales, units produced, or some other activity).

Both fixed and flexible budgeting are ways to prepare a budget for your business or division.

0 kommentar(er)

0 kommentar(er)